All Categories

Featured

Table of Contents

It's still totally moneyed in the eyes of the common life insurance firm. It's crucial that your policy is a blended, over-funded, and high-cash worth policy.

Bikers are added features and advantages that can be included to your policy for your particular needs. They let the insurance policy holder acquisition a lot more insurance or change the problems of future purchases. One factor you might intend to do this is to prepare for unanticipated illness as you grow older.

If you include an additional $10,000 or $20,000 upfront, you'll have that money to the bank from the get go. These are just some steps to take and think about when setting up your lifestyle banking system. There are several different ways in which you can make the many of way of life banking, and we can aid you locate te best for you.

Infinite Banking Concept Wikipedia

When it pertains to monetary planning, entire life insurance policy frequently stands apart as a popular option. Nevertheless, there's been an expanding trend of advertising it as a device for "unlimited banking." If you have actually been checking out entire life insurance or have come throughout this principle, you may have been told that it can be a method to "become your very own bank." While the idea may seem appealing, it's important to dig deeper to recognize what this truly suggests and why viewing entire life insurance coverage in this method can be deceptive.

The concept of "being your very own financial institution" is appealing because it recommends a high degree of control over your finances. This control can be imaginary. Insurer have the best say in just how your policy is taken care of, including the regards to the finances and the prices of return on your cash value.

If you're thinking about whole life insurance, it's important to see it in a wider context. Whole life insurance policy can be a valuable device for estate planning, supplying an ensured death benefit to your recipients and possibly offering tax obligation benefits. It can also be a forced savings automobile for those that have a hard time to conserve money consistently.

It's a kind of insurance policy with a cost savings component. While it can supply consistent, low-risk development of cash worth, the returns are normally less than what you may accomplish with various other investment automobiles. Before leaping into entire life insurance policy with the idea of infinite financial in mind, make the effort to consider your economic goals, risk resistance, and the complete array of financial products offered to you.

Unlimited financial is not a financial panacea. While it can operate in particular scenarios, it's not without threats, and it calls for a significant commitment and understanding to take care of efficiently. By identifying the potential pitfalls and recognizing truth nature of whole life insurance policy, you'll be much better outfitted to make an enlightened decision that supports your monetary health.

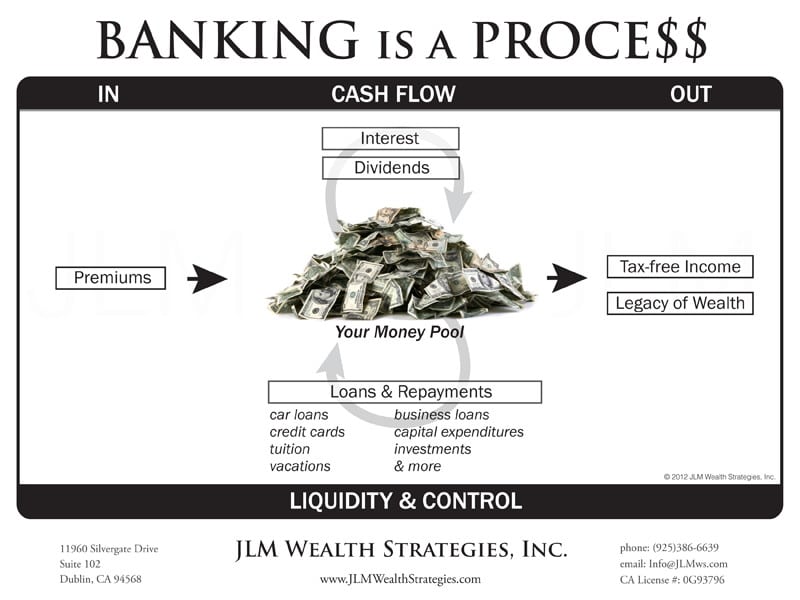

Instead of paying financial institutions for points we need, like autos, houses, and school, we can buy methods to keep even more of our cash for ourselves. Infinite Financial method takes an innovative strategy towards personal money. The method essentially entails becoming your own financial institution by utilizing a dividend-paying entire life insurance policy plan as your financial institution.

Infinite Banking System Review

It offers significant development gradually, changing the typical life insurance plan right into a strong economic device. While life insurance policy companies and financial institutions run the risk of with the variation of the market, the negates these threats. Leveraging a money value life insurance policy plan, people appreciate the advantages of assured growth and a fatality benefit protected from market volatility.

The Infinite Banking Principle highlights how much wealth is permanently moved away from your Household or Company. Nelson also goes on to describe that "you fund every little thing you buyyou either pay passion to someone else or provide up the interest you could have or else earned". The actual power of The Infinite Banking Idea is that it addresses for this trouble and encourages the Canadians that embrace this idea to take the control back over their funding needs, and to have that money moving back to them versus away.

This is called lost opportunity expense. When you pay money for points, you permanently surrender the opportunity to make rate of interest on your own financial savings over multiple generations. To fix this problem, Nelson produced his very own banking system via using dividend paying participating whole life insurance coverage policies, ideally via a mutual life business.

As an outcome, insurance policy holders need to meticulously evaluate their economic objectives and timelines prior to choosing for this approach. Sign up for our Infinite Banking Training Course.

Infinite Banking Concept Scam

How to get Continuous Worsening on the routine payments you make to your cost savings, emergency fund, and retirement accounts Just how to position your hard-earned money so that you will certainly never ever have another sleepless night worried regarding how the markets are going to respond to the next unfiltered Governmental TWEET or global pandemic that your family simply can not recover from Just how to pay on your own initially using the core principles instructed by Nelson Nash and win at the money video game in your very own life Just how you can from third celebration banks and lenders and relocate it right into your very own system under your control A streamlined way to make sure you pass on your wide range the way you desire on a tax-free basis How you can relocate your money from forever taxed accounts and shift them right into Never tired accounts: Hear exactly how people just like you can implement this system in their own lives and the influence of putting it right into action! The duration for developing and making substantial gains via boundless banking greatly depends on different elements unique to a person's economic position and the policies of the financial organization providing the solution.

An annual returns repayment is an additional substantial advantage of Limitless banking, more stressing its beauty to those geared towards long-term monetary growth. This method calls for cautious factor to consider of life insurance expenses and the analysis of life insurance coverage quotes. It's vital to examine your credit record and challenge any type of existing charge card financial obligation to ensure that you remain in a positive placement to adopt the strategy.

A key element of this method is that there is insensitivity to market variations, because of the nature of the non-direct recognition fundings used. Unlike investments connected to the volatility of the marketplaces, the returns in boundless financial are secure and predictable. Additional money over and above the costs payments can likewise be added to speed up growth.

Royal Bank Infinite Visa Rewards

Insurance holders make normal costs settlements into their getting involved entire life insurance policy plan to maintain it effective and to construct the policy's overall cash money worth. These superior payments are normally structured to be constant and predictable, guaranteeing that the policy stays energetic and the money value remains to expand in time.

The life insurance policy plan is developed to cover the entire life of a private, and not simply to aid their recipients when the individual passes away. That stated, the plan is getting involved, indicating the policy owner becomes a component proprietor of the life insurance policy firm, and joins the divisible earnings produced in the kind of returns.

"Right here comes Profits Canada". That is not the situation. When dividends are chunked back into the plan to purchase paid up additions for no additional cost, there is no taxable occasion. And each paid up enhancement additionally gets dividends every single year they're proclaimed. Currently you might have heard that "rewards are not assured".

Table of Contents

Latest Posts

Infinite Income Plan

Your Own Bank

Nelson Nash Infinite Banking

More

Latest Posts

Infinite Income Plan

Your Own Bank

Nelson Nash Infinite Banking